Greenfield investment occurs when a foreign company establishes (or expands) a business in the US. Most foreign direct investment (FDI) in the US are acquisitions. However, the “US affiliates of foreign multinationals spend hundreds of billions of dollars per year in the United States on research and development and capital expenditures, with the biggest shares going to manufacturing.” In short, we should welcome it.

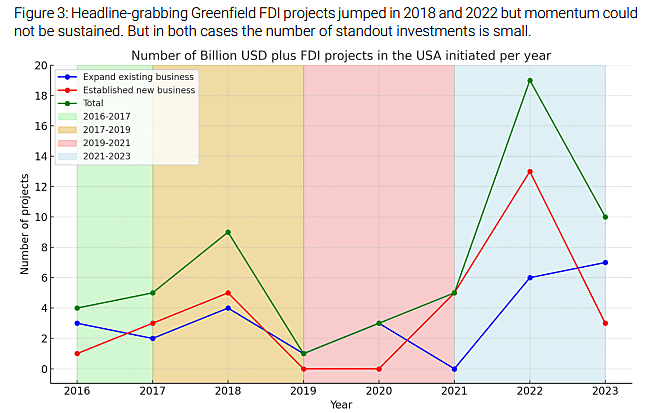

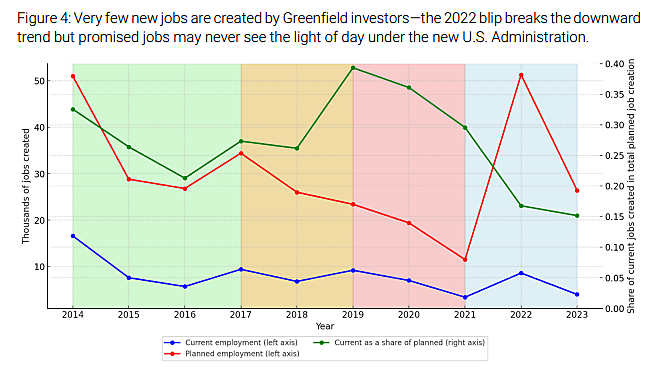

According to a new report from Global Trade Alert, however, neither the Trump tariff-driven approach to attracting greenfield investment to the US nor the subsidy-driven approach preferred by the Biden administration bore results beyond an initial “sugar high.”

Job creation, a stated aim of the presidents’ policies, trended south under both administrations.

The report also looks at the degree to which import tariffs motivated foreign investment into US manufacturing (“tariff-jumping”). Only two of the eight manufacturing sectors show that imports may have been replaced with more foreign investment, which “cast doubt on the effectiveness of both Trump (sticks) and Biden (carrots-and-sticks) approaches to reviving US manufacturing in part by repatriating production from abroad.”

Circling back to FDI via acquisitions, Japanese Nippon Steel’s proposal to acquire US Steel for $14.9 billion, which would come with $2.7 billion in badly needed investment in American steel facilities, has been on the ropes thanks to opposition from the Biden administration. President-elect Trump is also opposed to the deal. The opposition from the presidents comes despite reports that 90 percent of US Steel employees favor the deal.

Scott Lincicome has a detailed breakdown of the Nippon-US Steel matter. The main takeaway is that the Biden administration and Trump want the public to believe their opposition is based on national security concerns and “protecting workers.” The truth is they’ve both chosen to support union bosses at the expense of said workers and the economy in general.

Tariffs and taxpayer subsidies did not make the American economy the world’s most successful. Instead, the US’s success stems from cultural, economic, and institutional strengths that foster innovation and entrepreneurship. Sure, we could (and need to) do better by improving our relatively favorable regulatory environment and getting our fiscal house in order. But nationalist trade and industrial policies are counterproductive—as is stopping allies from investing here to placate union leaders.